Tally Integration with other Application Tally software has been designed to provide extensive integration capabilities…

Did you know that with Tally.ERP 9, reconciling your company’s bank book with the bank statement can be done automatically and accurately?

Bank reconciliation is an important process that helps a business to cross-verify its own books of accounts with the bank statement. Comparing the two statements with long list of transactions is stressful and error-prone using the manual and conventional method. However, Tally.ERP 9 will minimize the time spent and risk of making errors during bank reconciliation using the newly introduced auto bank reconciliation option.

Auto bank reconciliation in Tally.ERP 9 provides a simple and no-frills method of reconciling your company bank books with the bank statement. Using this option, you just need to import the e-statement you received from the bank to Tally.ERP 9 (in Excel or CSV format) and hit the reconcile button. Reconciliation will happen automatically. Not only this, Tally.ERP 9 also shows you a complete detail of any unaccounted for transactions, like Bank Charges or Bank Interests, between the bank statement and company’s books.

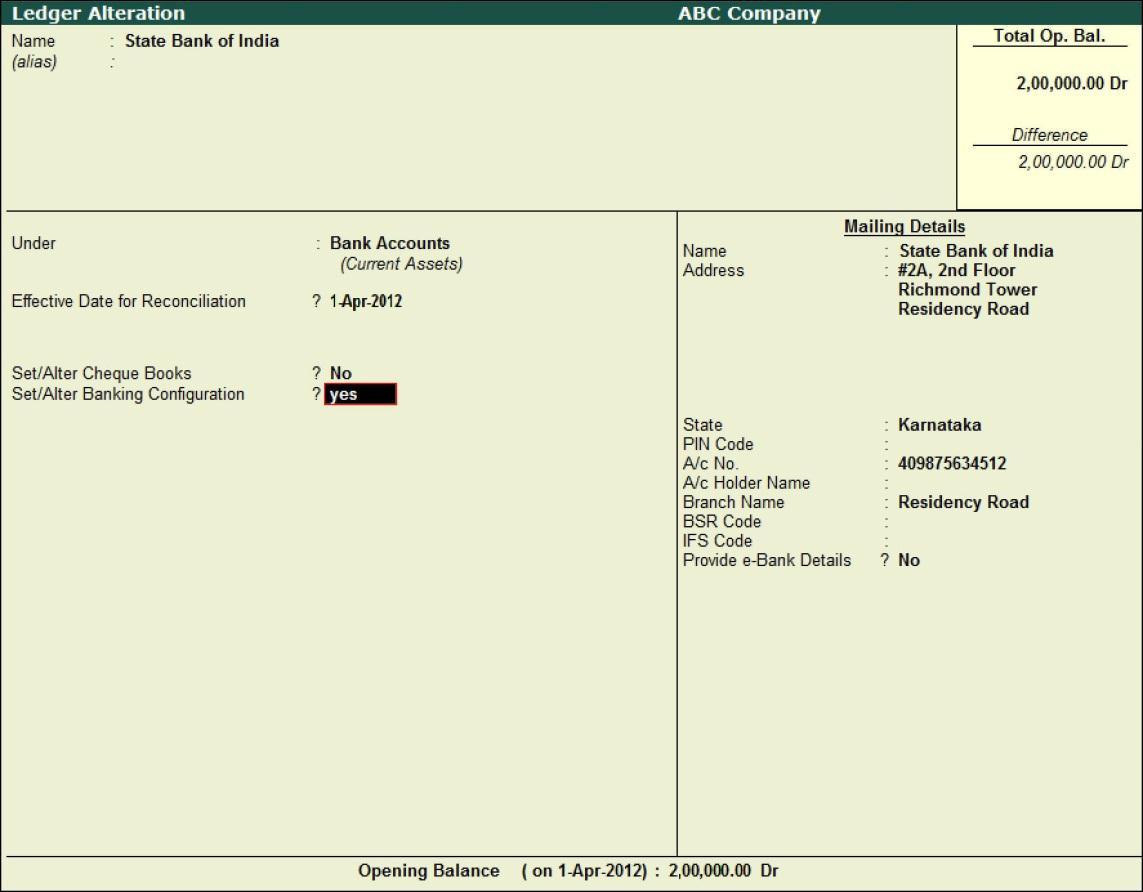

To carry out the auto bank reconciliation process, let’s suppose that a company receives its bank statement from State Bank of India and needs to be reconciled. To use Auto Bank Reconciliation in Tally.ERP 9, firstly, you need to enable this option in the bank ledger as shown:

- Open the bank ledger (State Bank of India in this case) in alteration mode

- Set ‘Yes’ to ‘Set/Alter Banking Configuration’

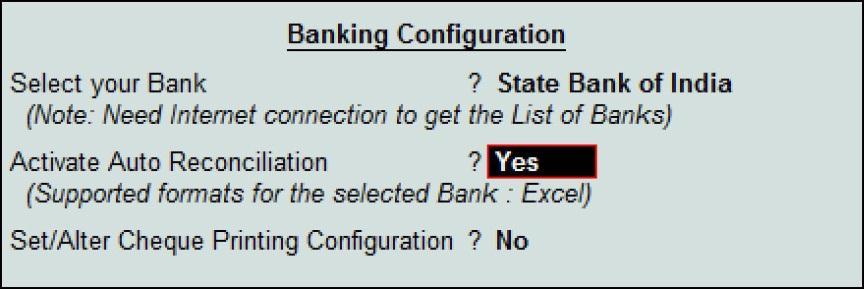

- Select the relevant bank from the ‘List of Banks’

- Set ‘ Yes’ to ‘Activate Auto Reconciliation’ as shown:

- Accept the screen

Note: Valid Tally.NET Subscription and Internet Connectivity are required for performing auto bank reconciliation

Using Auto Bank Reconciliation in Tally.ERP 9

After enabling the Auto Bank Reconciliation option, now you can go ahead and reconcile the bank statement with the company’s books as follows:

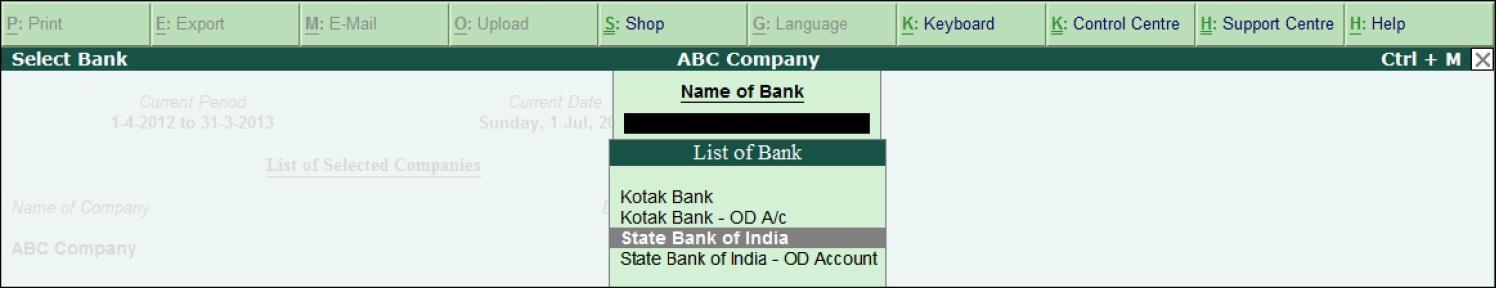

- Go to ‘Gateway of Tally > Banking > Bank Reconciliation’

- Select the required bank from the ‘List of Bank’

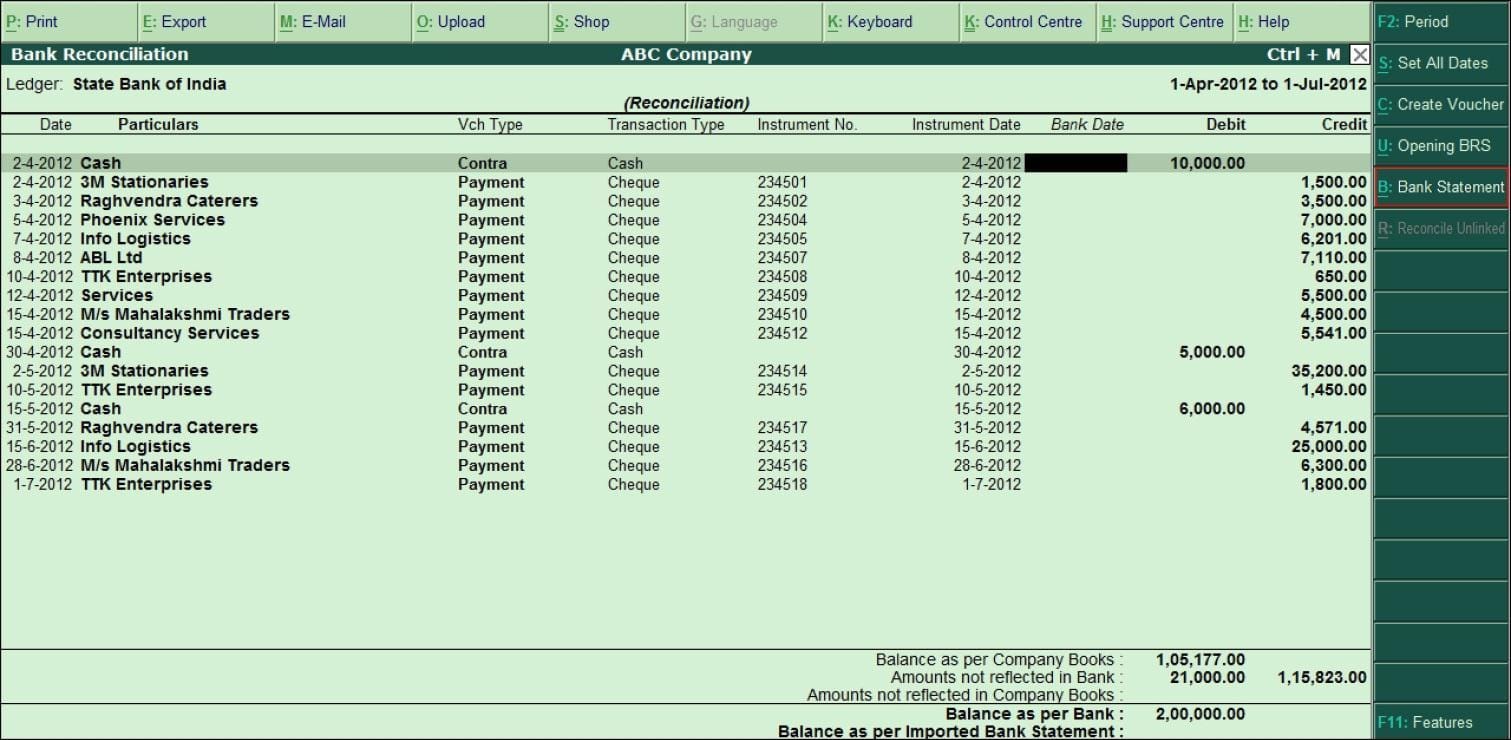

- On the ‘Bank Reconciliation’ screen, press ‘B: Bank Statement’ or ‘Alt + B’

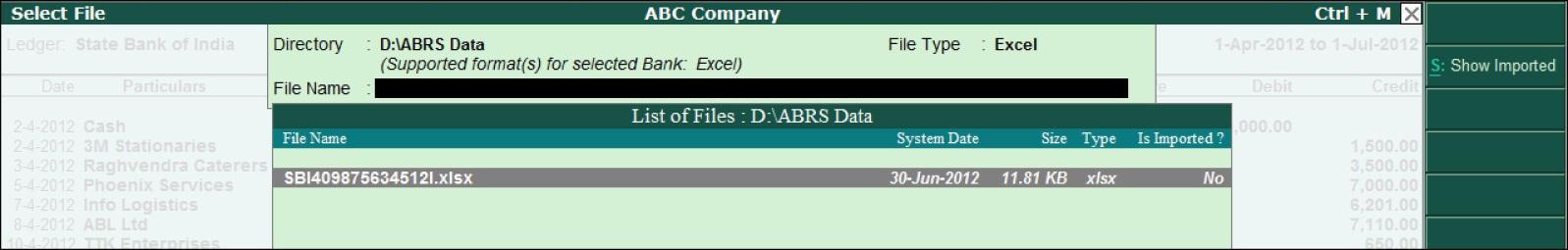

- Specify the ‘Directory’, where you have saved the downloaded bank statement

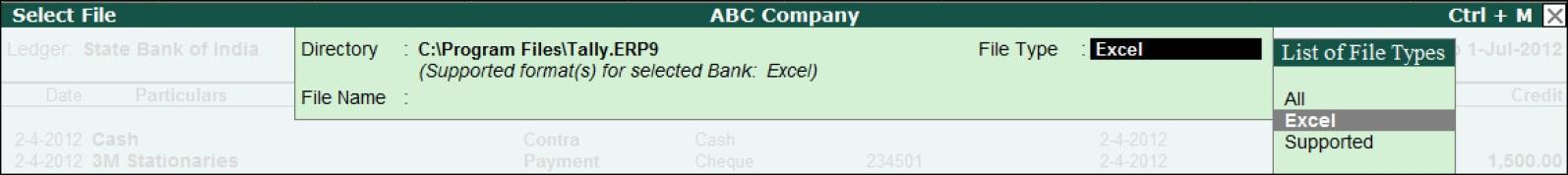

- In case you need to change the ‘File Type’, you can press ‘Backspace’ to select the appropriate ‘File Type’ for the bank statement to be imported

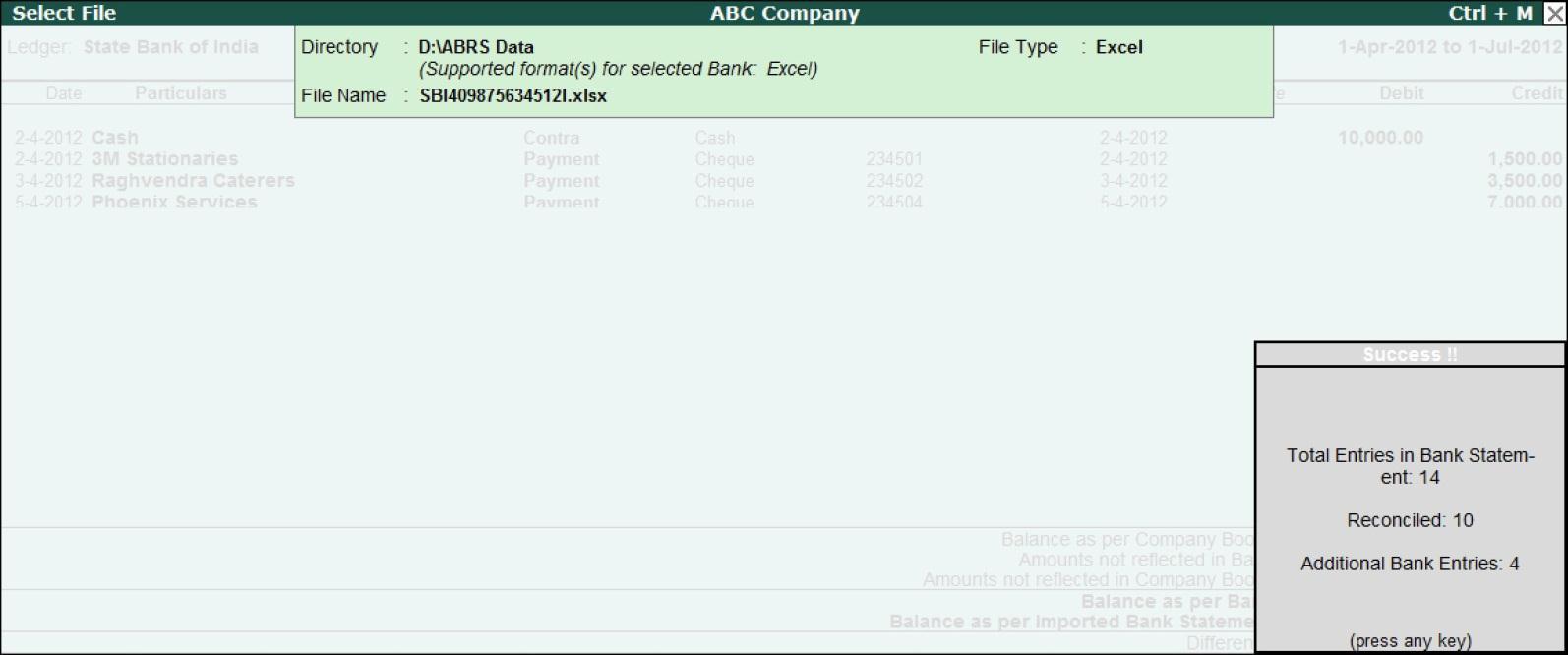

- Once you’ve selected the required ‘File Type’, select the required bank statement file from the ‘List of Files’, reconciliation will happen automatically

- Once the reconciliation happens, a ‘Success!!’ notification will be displayed with details like ‘Total Entries in Bank Statement’, number of entries reconciled and ‘Additional Bank Entries’

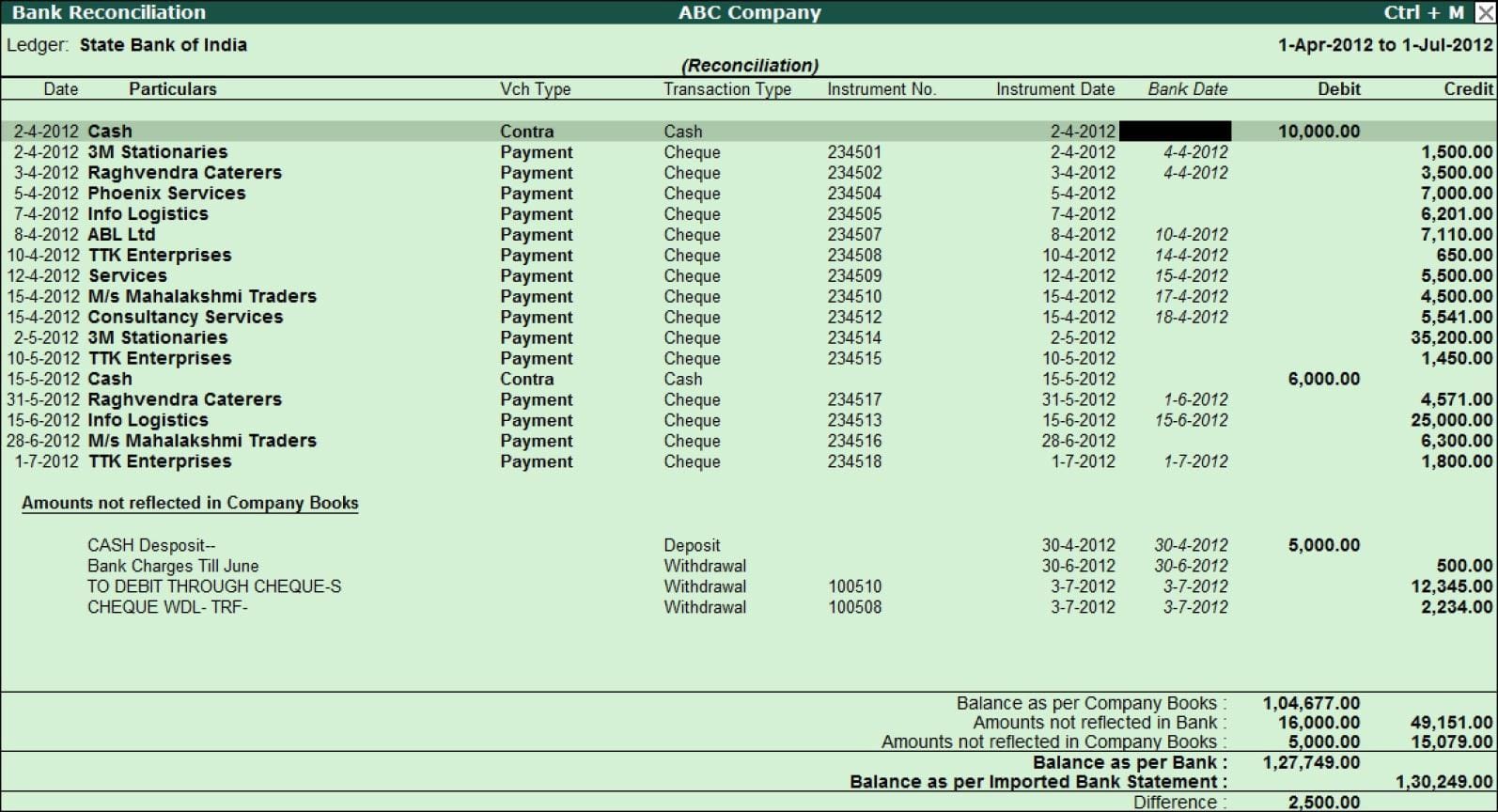

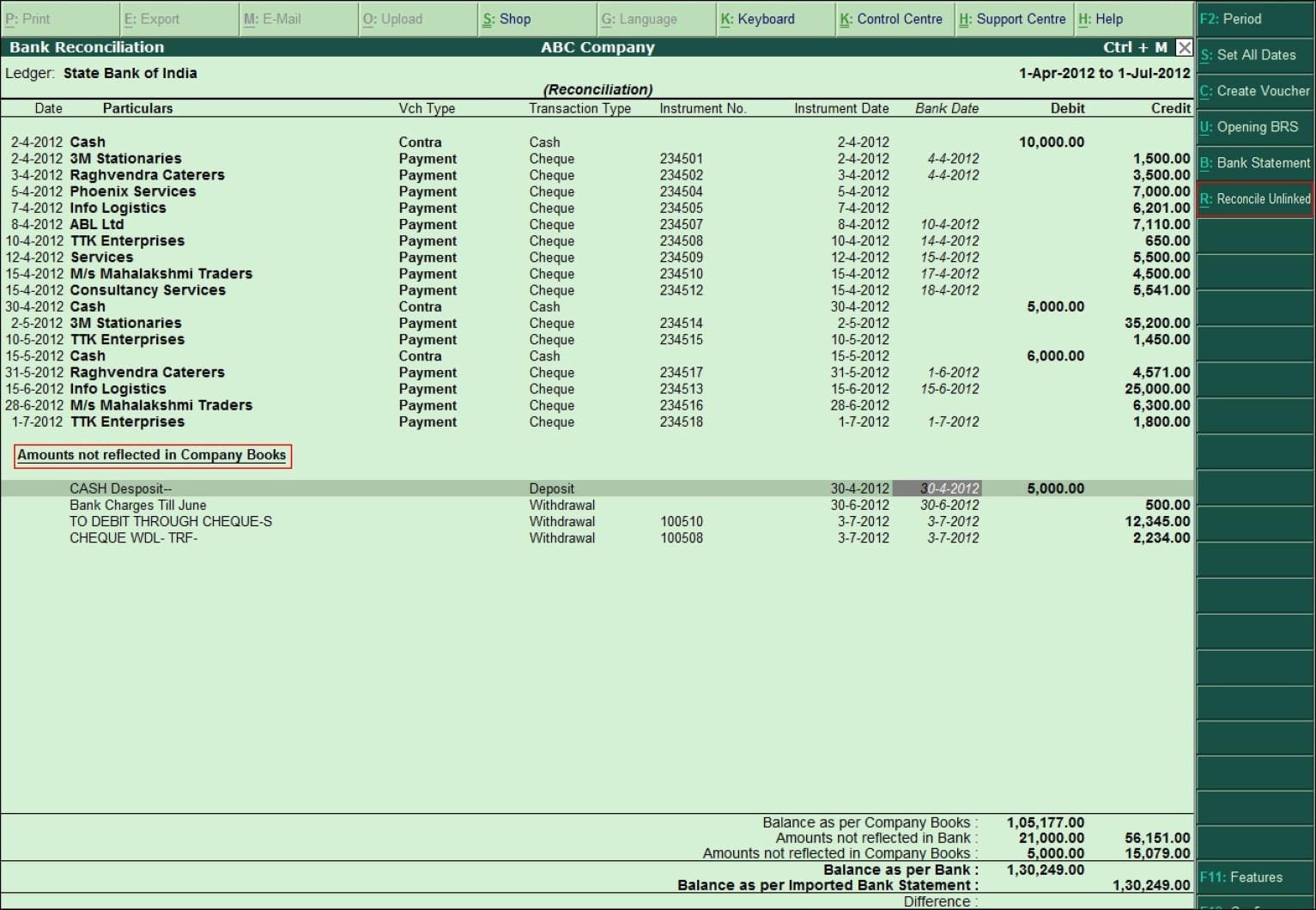

- Press any key and the Bank Reconciliation Statement with Imported bank statement details will appear. It shows the unreconciled list of entries from the bank statement under ‘Amounts not reflected in Company Books’ as shown:

Reconciliation of Amounts not reflected in Company Books

Entries that appear under ‘Amounts not reflected in Company Books’ are those which have not been reconciled and there can be two scenarios for the same.

Scenario 1: This could be because of either an incorrect or missing instrument number during the voucher creation. For example, Cash Deposit to the bank will not have an instrument number in your company books.

To reconcile these unreconciled amounts:

- Select the required entry (Cash Deposit in this case) under ‘Amounts not reflected in Company Books’ and press ‘R: Reconcile Unlinked’ or ‘Alt+ R’

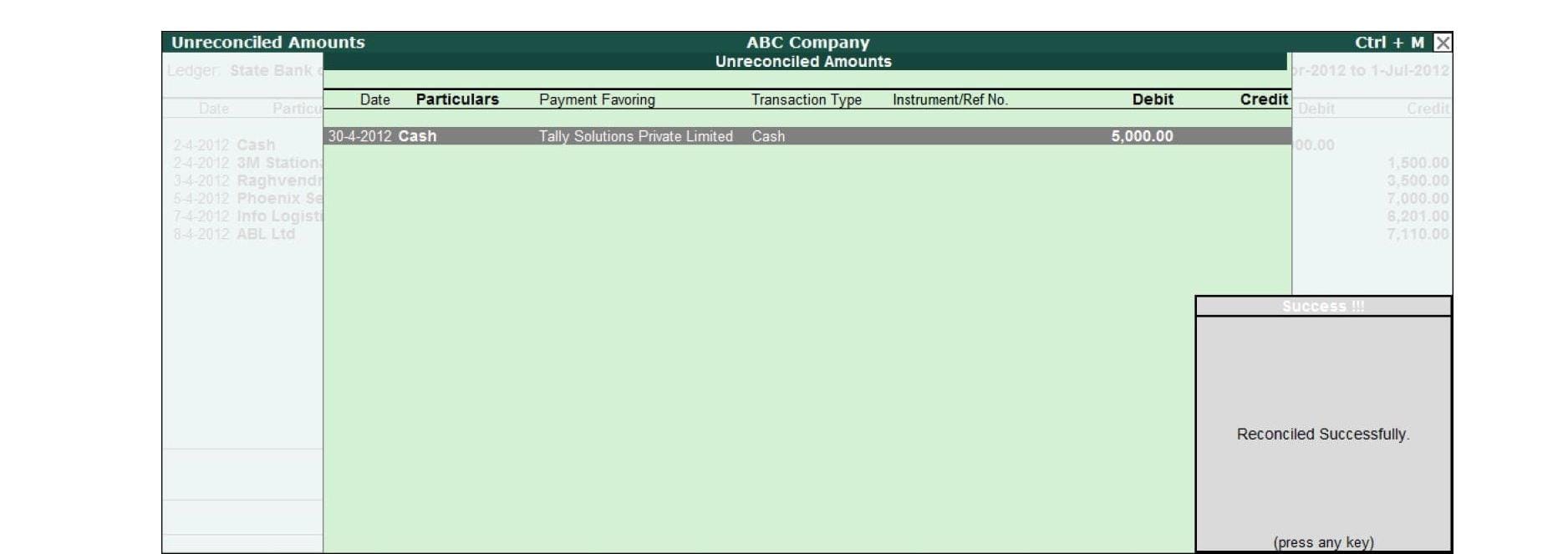

- This will show in ‘Unreconciled Amounts’ screen and it will display all the transactions matching the selected unreconciled transaction.

- Select the appropriate transaction and press ‘Enter’ to reconcile

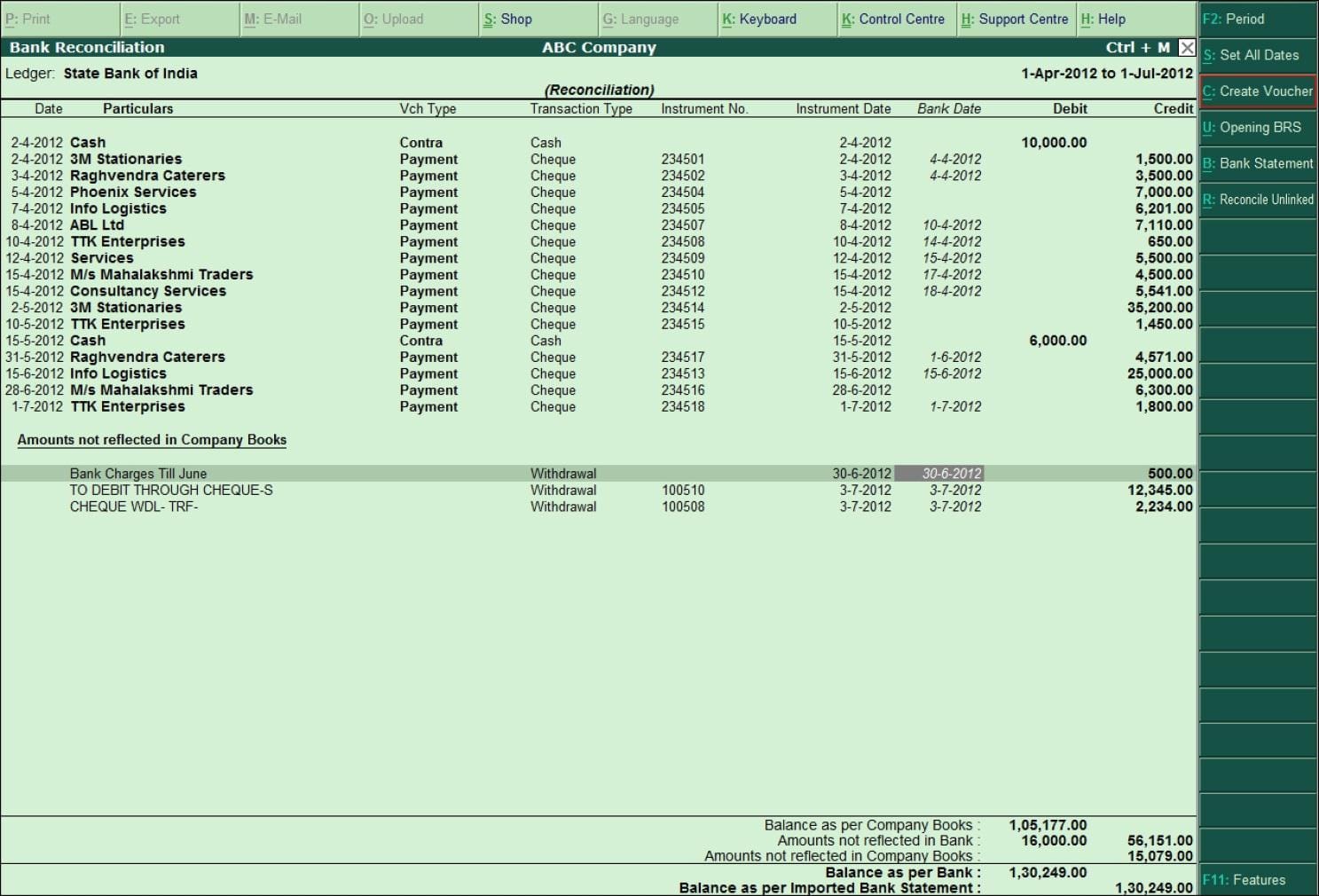

Scenario 2: Deposits or withdrawals recorded in bank statement but not recorded in your company books due to lack of information. For example, ‘Bank Charges’ levied by the bank. To reconcile these entries:

- Place the cursor on the required transaction ( Bank Charges in this case),

- Press ‘C: Create Voucher’ or press ‘Alt+C’

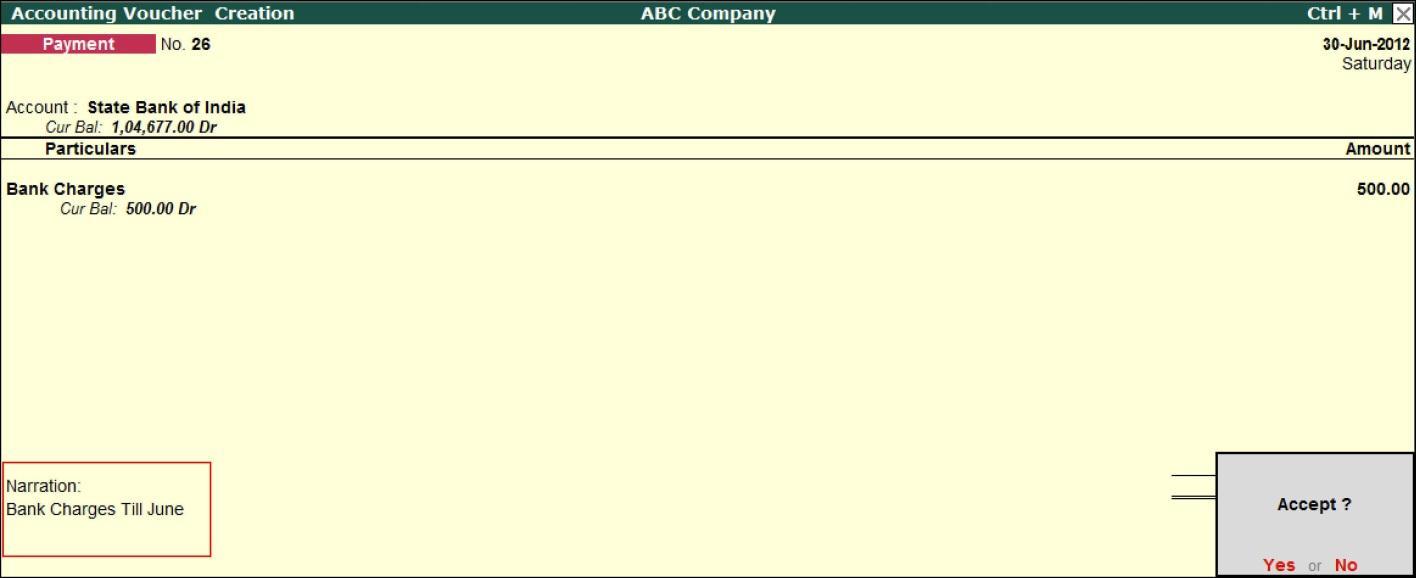

- On the voucher creation screen, the amount field and the narration field are already filled with details captured from the bank statement

- Select the required Ledger and the instrument number in the bank statement will be automatically captured in the ‘Bank Allocations’ screen

- Press ‘Enter’ to accept the screen

Hence, Tally.ERP 9 provides a quick, simple and stress-free Automatic Bank Reconciliation option for your business to save you time, manpower and money.